Spring is right around the corner which means if you’re a student, you may have already started looking for a summer job. Or maybe you’re planning for summer nights with friends, traveling, or even buying necessities for college. As a student just beginning to earn money, deciding how to manage your earnings can be overwhelming. The good news is that a student checking account is an easy and convenient way to begin your banking journey.

What you need to know about student checking accounts

A student checking account is a bank account that offers a debit card, check-writing, a safe place to keep your money and access to your money via online and mobile banking. Most student checking accounts have fewer restrictions to open and few (or zero) fees. Typically, a student checking account has a lower initial deposit to open the account.

So really, it’s a win-win situation for you. As a student opening a checking account, you’ll have access to its many benefits, without having to put down much money to open it. Now that you know just how easy it can be to open a student checking account, let’s talk features of a student checking account.

Debit card access

Debit cards are a great start to learning how to manage your money. They are different than a credit card. They allow access to the money you have in your account. Debit cards make it easy to carry and withdraw money from ATMs. Out with friends? Splurging for pizza? Gas tank low on fuel? If you’ve got the money in your checking account, a debit card is a great way to pay.

Check-writing

Checks are great to have when a particular business or person cannot accept a debit card, or online payment methods or to avoid processing fees sometimes associated with card payments. For instance, when paying your rent, mortgage, or utility bills. Some companies only accept payment by check. It might seem like something you will never use as a student. And it’s possible because means of payment are changing every day. But, if your landlord or utility asks you to pay rent via check, with a student checking account, you’ll have access to this important feature.

Checks from your student checking account also feature both your account number and routing number. You’ll often see the option to pay by “e-check” or, for instance, when you’re paying your student tuition, you’ll be asked to input your routing and account number to avoid payment fees. While you can look up your routing and account number through your online bank account, you’ll also find these numbers on your checks.

Mobile banking and online banking access

Online banking is a convenient way to access your money. You can use your bank’s mobile app to manage your account right from your phone. The app gives you freedom to budget and check your balance any time. Constantly having a handle on your finances allows you to make smart spending decisions. Imagine not having the ability to check your balance from anywhere, only having a guess about how much is in your account. It would certainly be more difficult to make decisions on spending! This is why every student checking account comes with real-time online banking access.

Mobile banking gives you the opportunity to see all transactions you make, so you can keep track of what you spend and where. This is a great way to monitor for fraudulent charges, since you can see what exactly is coming out of your account. Mobile check deposit is another convenient feature, so you can deposit any checks you receive without needing to take the time to visit the bank in person.

Provides a safe place to keep your money

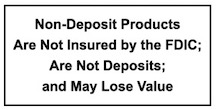

When you’re a student and just beginning to earn and manage your own money, you want to know that your money is secure! It’s important to open a bank account insured by the Federal Deposit Insurance Corporation, or FDIC. FDIC-insured banks protect the first $250,000 of each account. This way, the money you deposit in a checking account will be insured. Basically, if your bank went out of business, you’d still get your money back, thanks to the FDIC’s protection.

Benefits of opening a student checking account

Opening a student checking account is a great first step to begin a successful financial future. You can gain and practice independence and begin building a solid foundation for saving and spending. When using a debit card or accessing online banking you can learn about budgeting and setting financial goals while helping create good spending and saving habits.

But the best part – with a student checking account you have quick and easy access to your money. It’s simple to withdraw, spend, or send money.

Which student bank account is best?

Deciding to open a student checking account is the easy part. Choosing which bank can be tough. You may look through many similar options, but still end up wondering which student bank account is best. So, how do you pick? The right one should be from a trustworthy bank and have excellent features. Here’s where we come in.

At Hickory Point Bank, we believe hard working students should be rewarded, so we’ve created an affordable student checking account. You get all the great features of our normal Classic Checking, and we waive the monthly (xx) service fee as long as you are enrolled in school full-time.

Your time is valuable. Your dollars are hard-earned. You don’t invest without doing your homework–and neither do we. At Hickory Point, we’re not just another bank. We’re our own bank.

Our student checking account has all the best features, giving you control over your finances.

HPB Student Checking Highlights

- Unlimited check writing

- Unlimited ATM withdrawals

- Debit card

- $100 minimum opening deposit

No fees on

- Online banking

- Mobile banking with the HPB Banking App

- Paperless Statements

How to open a student checking account

Ready to begin and want to know how to open a student checking account?

Opening a student checking account is quick and easy with Hickory Point Bank.

Once you’ve opened a student checking account, check out our saving tips for students to start leveraging the features of your new account to work towards your financial goals.